What to Bring With You to Your Appointment

Intake/Interview Form

Every taxpayer who visits us must fill in an IRS Form 13614-C, Intake/Interview and Quality Review Sheet every year. You are encouraged to fill in the PDF (click above link), print it and bring it with you. You can also pick up a form from any of our sites before your appointment (click here for locations and dates). Otherwise, please plan to arrive at your appointment at least 15 minutes early to fill in the form. Thank you!

Bank Account Information

The IRS will no longer automatically issue a tax refund by check. If you do not opt to have your tax refund direct deposited or applied to next year’s tax return, your refund will be delayed by several months. Bring a check or other document with your Bank’s routing number (RTN) and your account number. (This is new for Tax Year 2025.)

Identification Protection PIN (IP PIN)

If the IRS has issued an IP PIN to you or anyone on your return then you need the current year’s PIN to e-file your tax return. If you have a PIN then the IRS sends you a new PIN in the mail every year. You should bring this letter with you to your appointment and let your preparer know that you have one. For more information on IP PIN’s click here.

If You Are Filing “Married Filing Jointly” (MFJ)

If you are filing MFJ then the signatures of both spouses are required for your return. If one spouse is unable to be at the appointment then you may sign for your spouse if you have a current Power of Attorney with you. Otherwise, your preparer can give you a draft copy of your return and the form 8879 which you must return with both signatures before the return can be filed.

If You Are Filing “Married Filing Separately” (MFS)

If you are filing MFS then you must know your spouse’s Social Security Number. You must also know if your spouse has filed and itemized deductions or will do so. The alternative to itemizing is taking the standard deduction.

General

- All correspondence received from the IRS and your state/local taxing authority.

- Social Security cards and/or Individual Taxpayer Identification Number notices/cards or other official documentation that show the taxpayer identification numbers for every individual on your return.

- Government-issued photo ID for each taxpayer.

- Checking or savings account information if you want to direct-deposit any refund(s) or direct-debit any amounts due.

Income

- W-2 forms for each employer.

- 1099-G form for unemployment compensation or state/local income tax refunds.

- SSA-1099 form showing the total Social Security benefits paid to you for the year, or RRB-1099, Tier 1 railroad retirement benefits form.

- 1099 forms (or other statements) reporting interest (1099-INT), dividends (1099-DIV) and/or proceeds from sales (1099-B), plus documentation showing the original purchase prices if you sold stocks or other assets.

- 1099-R form if you received a pension, annuity or IRA distribution.

- 1099-MISC, 1099-K or other 1099 forms. If you have a business, bring a summary list of all your income (cash and noncash) and all business-related expenses.

- Information about any other income of any form, including cash.

- Tax document that you may have received from your state.

Payments

Records of any federal and/or state and/or local income tax paid (including quarterly estimated tax payments) if not shown on income documents.

Deductions

Most taxpayers have a choice of taking either a standard deduction or itemizing their deductions. You need to have more itemized deductions than the standard deduction. If you have a substantial amount of deductions, you may want to itemize. If so, bring the following information:

- 1098 form showing home mortgage interest.

- A summary list of medical/dental/vision expenses, including doctor and hospital bills and medical insurance premiums, prescription medicines, assisted living services, long-term insurance and bills for medical-related home improvements such as ramps and railings for people with disabilities.

- Summary of cash and noncash contributions to charity.

- Property tax bills paid during the year (frequently shown on mortgage statement).

- 1095-A forms if you purchased insurance through the marketplace (exchange).

Credits/adjustments

- Dependent care provider information — name, address, telephone number and employer ID or Social Security number and amount paid to provider.

- 1098-T form for education expenses plus statement of account from the educational institution showing tuition and fees actually paid and scholarships, grants, etc. received. Bring a summary of any other education expenses.

- 1098-E form for student loan interest.

Prior Year Tax Returns

Please bring your tax returns for the last two years. We don’t always need them but often we do.

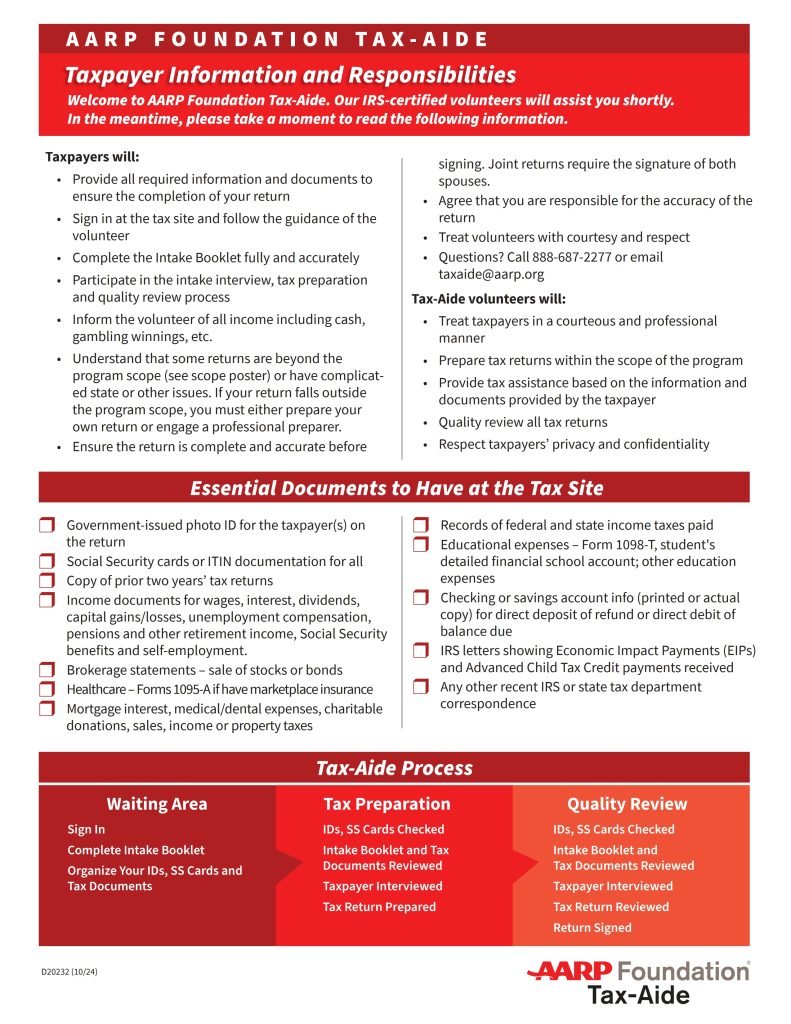

Responsibilities